tn franchise and excise tax mailing address

Thank you for submitting your Franchise and Excise Tax Annual Exemption Renewal FAE 183 online at Tennesseegov. Input the Contacts name phone number and email address.

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Corporation Limited Liability Company Limited Partnership - financial institution or captive REIT Form FAE174 Schedules and Instructions - For tax years beginning on or after 1121. For additional information about these items contact Ms.

Tennessee Department of Revenue 500 Deaderick Street Nashville TN 37242. The excise tax is based on net earnings or income for the tax year. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax.

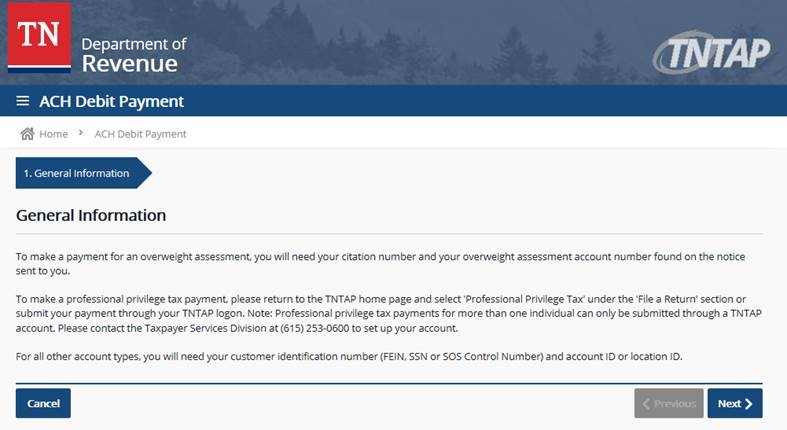

Tennessee Department of Revenue. To determine your account number for other tax types please contact the Taxpayer Services Division at 800 342-1003 in-state or. E-file-6 - Departments Use of Bank Account Information.

Your confirmation details are below. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone. Place a check mark in the space next to every tax type that will be affected by the change of address provided.

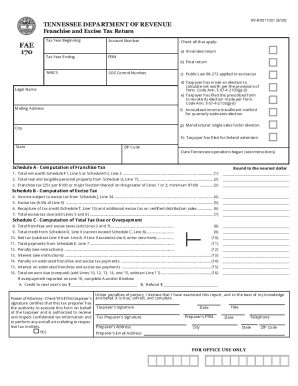

FE-5 - Due Date for Filing Form FAE170 and Online Filing Requirement. TENNESSEE DEPARTMENT OF REVENUE Application for Extension of Time to File Franchise and Excise Tax Return RV-R0011401 1217 Tax Year Beginning Tax Year Ending Mailing Address City Legal Name State ZIP Code FEIN. E-file-7 - Exceptions to Electronic Payment Requirement.

E-file-11 - Financial Institutions and Captive REITs Required to File Electronically. FE-7 - The Date an Entity Formed Outside of TN Becomes Subject to. E-file-8 - Electronic Payment Requirements Increase Efficiency.

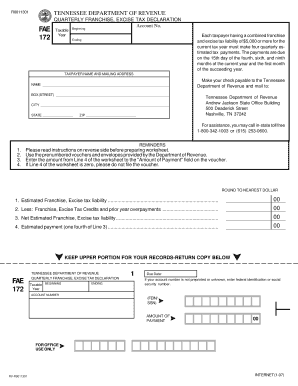

E-file-10 - Online Payment Maximum. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Choose the Period this should be the filing period end date you want the estimated payment to be credited.

Mary Van Leuven JD LLM is a director Washington National Tax at KPMG LLP in Washington DC. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the. ET-1 - Excise Tax Computation.

FONCE-4 - The FONCE Exemption When No Income Was Generated. Franchise Excise Tax - Excise Tax. Please view the topics below for more information.

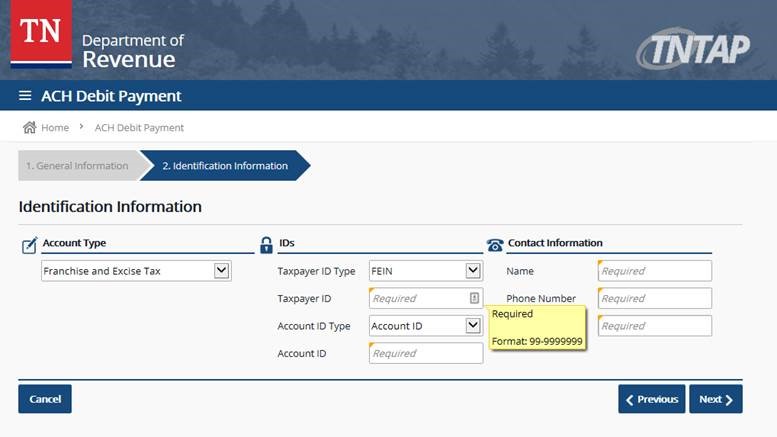

For questions or assistance with this form please call 615 253-0700 Monday through Friday 830 am-430 pm. Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V. Fill in the Taxpayer ID Type ID and Account ID.

ET-2 - Federal Bonus Depreciation is. You can search for your account number for the following tax types on Tennessee Taxpayer Access Point TNTAP. The franchise and excise tax.

8 rows Statewide toll-free. For Account Type choose Franchise Excise Tax. If you have entered your e-mail address you will receive an e-mail confirmation shortly.

Return Mailing Address without Refund. CST or visit wwwtngovrevenue for more detailed information. Contributors are members of.

If you have questions about Franchise And Excise Tax Online contact. Tennessee Department of Revenue Attention. Sales and use tax.

TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. FE-6 - Application for ExemptionAnnual Exemption Renewal Form FAE183 Due Date. Effective May 28 2018 franchise excise tax account numbers now called IDs have been updated from nine digits to 10 digits followed by the letters FAE.

FONCE-3 - Entity Types That May Qualify for the FONCE Exemption. Please be aware that information you have. Franchise Excise Tax Return Mailing Address Tennessee.

FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption. Fill in payment details. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn.

Return this change of address form to the Tennessee Department of Revenue Taxpayer Services Division Andrew Jackson Office Building 500 Deaderick Street Nashville Tennessee 37242. Schedule 170NC. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership.

If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero. Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. Please mail completed applications and annual renewals to.

4 rows Business Mailing Addresses. Please view the topics below for more information. You will not be able to print this page at a later time.

FONCE-2 - Relationships That are Considered Family Members for the FONCE Exemption. E-file-9 - Calculating Penalty and Interest. Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years.

Franchise and excise tax. Form IE - Intangible Expense Disclosure. TN 37242 Department Contact Information.

Andrew Jackson State Office Building 500 Deaderick Street Nashville TN 37242. 615 253-0700 1-800-342-1003 ln State Toll-Free E-mail. These letters identify the account as a franchise excise tax account.

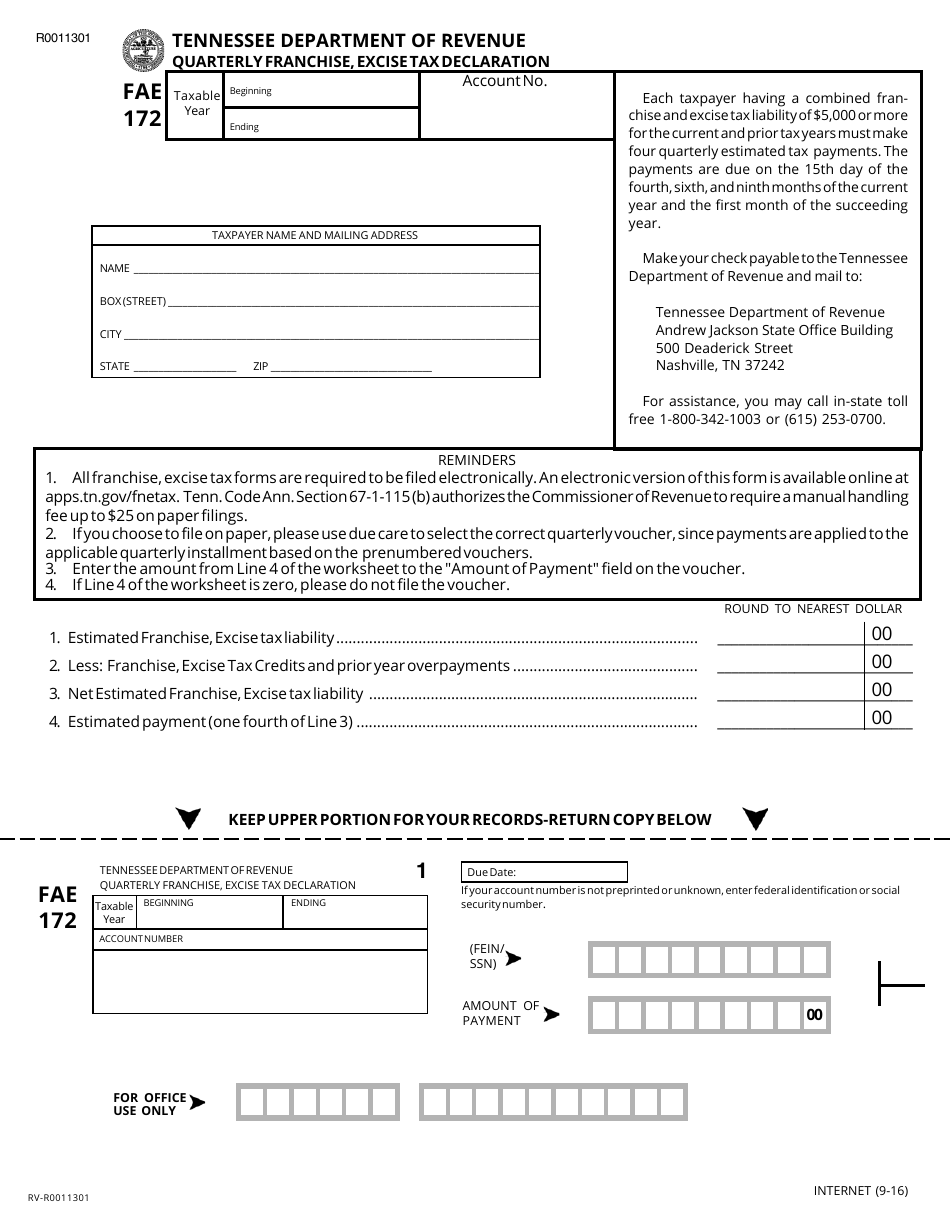

Fae172 Fae 172 Quarterly Franchise Excise Tax Declaration State Tn Fill And Sign Printable Template Online Us Legal Forms

Fill Free Fillable Forms State Of Tennessee

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Franchise Excise Tax Exemptions Farming Or Personal Residence Youtube

Tn Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Department Of Revenue Tntaptuesday Reminder Hall Income Tax Is Due July 15 You Can Conveniently File Pay From The Tntap Homepage Visit Tntap Tntap Tn Gov Eservices And Click File Hall Income Tax Tnrevenue

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Annual Reports And Franchise And Excise Taxes In Tennessee

Tennessee Department Of Revenue Forms And Templates Pdf Download Fill And Print For Free Templateroller