omaha ne sales tax rate 2019

Sales and Use Tax. 800-742-7474 NE and IA.

Sales Taxes In The United States Wikiwand

Omaha Nebraska and Palo Alto California Change Places.

. How does the Omaha sales tax compare to the rest of NE. 2020 rates included for use while preparing your income tax deduction. AP Republican gubernatorial challenger Tim James on Wednesday called for a repeal of Alabamas 2019 gas tax.

The Nebraska state sales and use tax rate is 55 055. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax while the city of St. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019.

State Sales Tax. Request a Business Tax Payment Plan. 100 US Average.

February 2019 55. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. Sales Tax on Food.

Nebraska Department of Revenue. The following rates apply to the DOUGLAS. 800-742-7474 NE and IA.

Ohiowa NE Sales Tax Rate. State Income Taxes. There is no applicable county tax or special tax.

Nebraskas sales tax rate is 55 percent. But the committee was split over whether to lower the state sales tax rate or local property taxes which one senator called the marquee issue in. For tax rates in other cities see Nebraska sales taxes by city and county.

Below 100 means cheaper than the US average. 550 Is this data incorrect Download all Nebraska sales tax rates by zip code. How The County Inheritance Tax Works Nebraska S Sales Tax 2020 The Year Of The Roth Ira Conversion Lutz Financial Nebraska Tax Rates.

May 26 2019. Nebraska Department of Revenue. Ong NE Sales Tax Rate.

The bill requires online retailers to collect sales taxes once they have 100000 worth of sales or at least 200 transactions in Nebraska. LINCOLN Nebraska closed out its fiscal year on a record high note with net tax revenues nearing 635 billion according to a new state report. Omaha ne sales tax rate 2019 Sunday July 31 2022 Edit.

March 2019 55. Sales Taxes Amount Rate Omaha NE. You can print a 7 sales tax table here.

Orchard NE Sales Tax Rate. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. The Nebraska state sales and use tax rate is 55 055.

Ad Have you expanded beyond marketplace selling. Rates include state county and city taxes. Sales Tax Rate Finder.

Close online purchasing shopping credit card black. Effectively Pender will not have a local sales. State Tax Rates.

The 7 sales tax rate in Omaha consists of 55 Puerto Rico state sales tax and 15 Omaha tax. The Nebraska Department of Revenue report. January 2019 55.

Also effective October 1 2022 the following cities. The latest sales tax rates for cities starting with A in Nebraska NE state. Sales Taxes In The United States Wikiwand Sales Taxes In The United States Wikiwand Nebraska S Sales Tax Sales Taxes In The United States Wikiwand.

For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. City Tax Special Tax.

Make a Payment Only. April 2019 55. Nebraska sales tax changes effective July 1 2019.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. The local sales tax rate in Omaha Nebraska is 7 as of August 2022. Omaha NE Sales Tax Rate.

The Gretna Nebraska sales tax is 550 the same as the Nebraska state sales tax. - Single standard deduction one exemption - Sales Tax includes food and services where applicable. City Tax Special Tax.

Avalara can help your business. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. Real property tax on median home.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

Tax News Views Minimum And Bachelor Tax Roundup

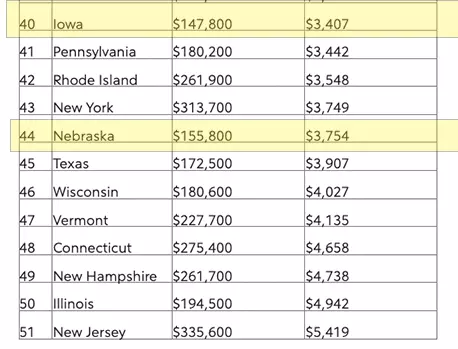

New Ag Census Shows Disparities In Property Taxes By State

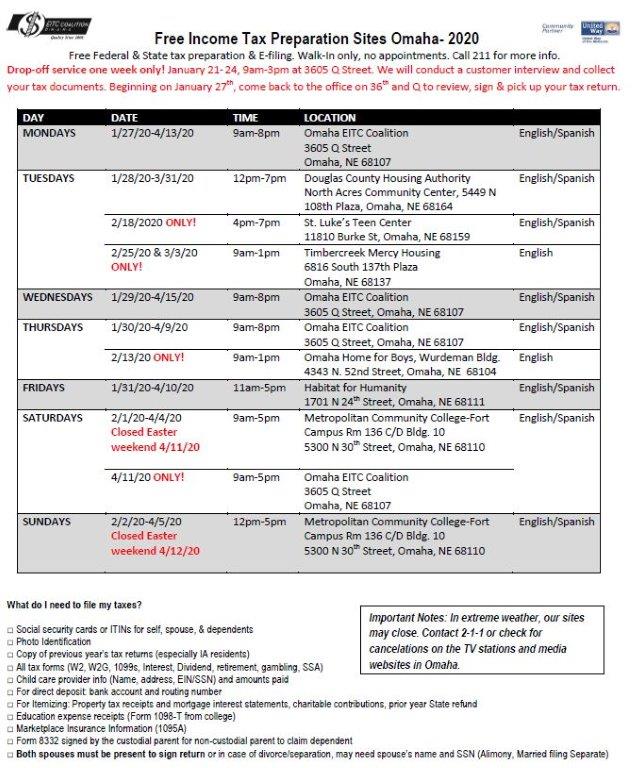

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

6917 Halsey Dr Shawnee Ks 66216 Realtor Com

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Taxes In The United States Wikiwand

Cryptocurrency Tax Calculator Forbes Advisor

Nebraska Sales Use Tax Guide Avalara

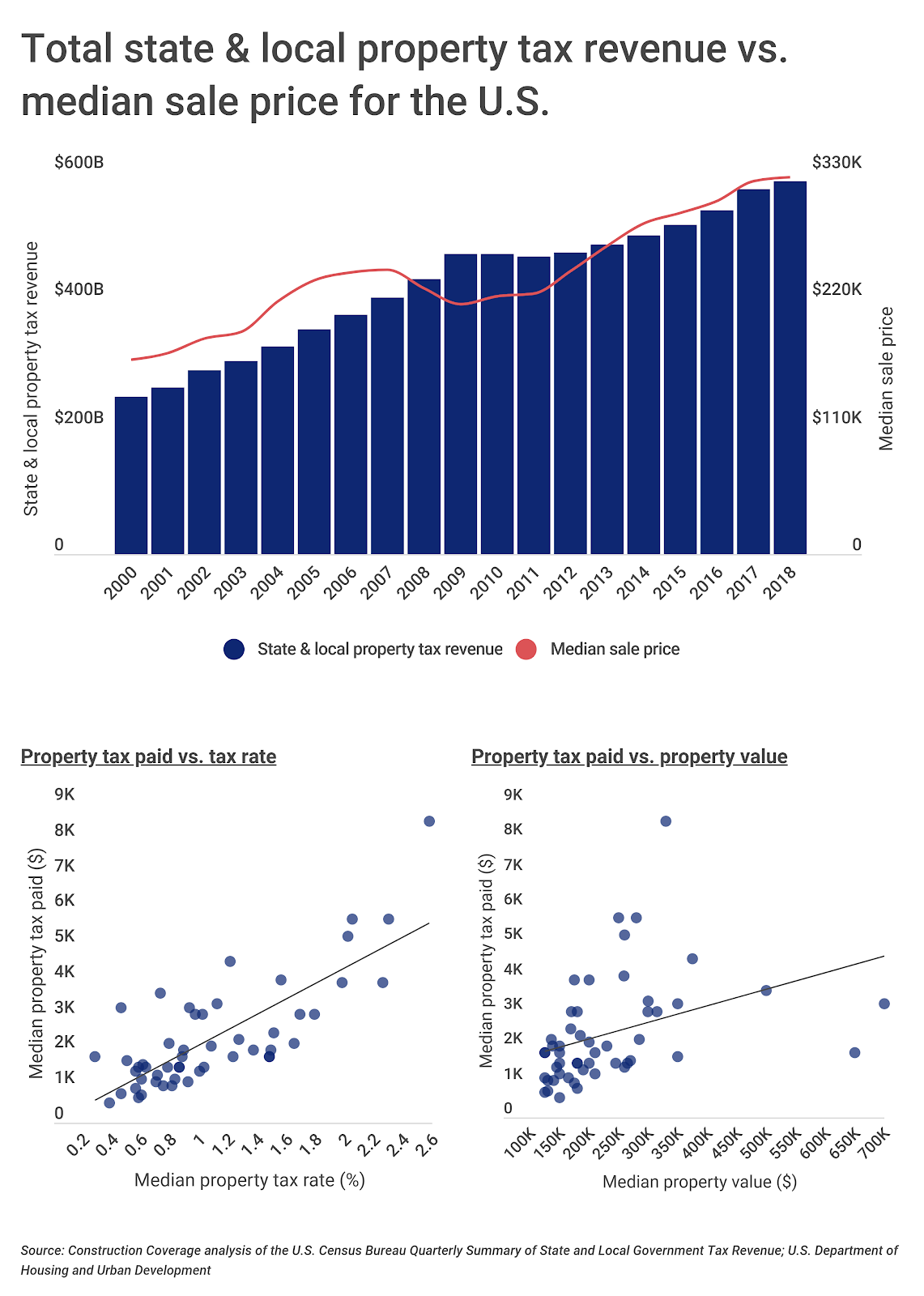

Property Taxes Explained Omaha Relocation

Fact Check Does Texas Have Some Of The Highest Property Taxes In The Nation State And Regional News Wacotrib Com

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand